In an era where online transactions have become the norm, many question the safety of using money apps like Venmo. As a widely used app for peer-to-peer payments, Venmo has undoubtedly made money management easier. However, as convenience arises, so too do the concerns over security. In particular, we’re referring to the threats posed by a Venmo scam.

For this guide, our aim is to shed light on the reality behind these scams. We provide you with valuable knowledge to continue using Venmo in relative safety.

Let’s jump in!

Understanding of Venmo scams

Having an understanding of the different scams on Venmo should be a requirement for all users of this payment app. It not only empowers you to recognize potential threats, but also enables you to take necessary precautions to protect your funds.

Cybersecurity threats are constantly evolving and becoming more sophisticated; unfortunately, Venmo scams are no different. By familiarizing yourself with these scams, you can ensure that you resist the efforts of cyber-criminals.

Consider a study conducted by the Pew Research Center revealing that 1 in 10 users reported being victims of online fraud or scams while using Venmo. Now, 10% may not sound significant, but when you consider the fact that Venmo boasts more than 70 million active users, it is immediately evident that the risk is real and must not be underestimated.

Whether you frequently use Venmo or are contemplating joining the platform, it’s crucial to be aware of the typical scams and how to protect yourself against them in order to maintain your financial security.

Is Venmo Safe?

Answering this question isn’t as simple as a straightforward “yes” or “no.” Technically speaking, Venmo is considered generally safe-to-use, as it adheres to all relevant regulations in safeguarding its users’ financial transactions. It employs data encryption technology to prevent unauthorized transactions and even offers the option of setting up a PIN code for added log-in security on its mobile application.

However, similar to any financial transaction platform, Venmo is not immune to scams and fraudulent activities. The weak point in Venmo’s safety measures lies within its user base. To illustrate this, let’s delve into some of the most common scams.

Common Venmo scams

In this section, we’ll cover some of the most frequently encountered types of scams on Venmo and explain how they operate. Understanding these scams is crucial as it helps you become better prepared to identify and avoid them.

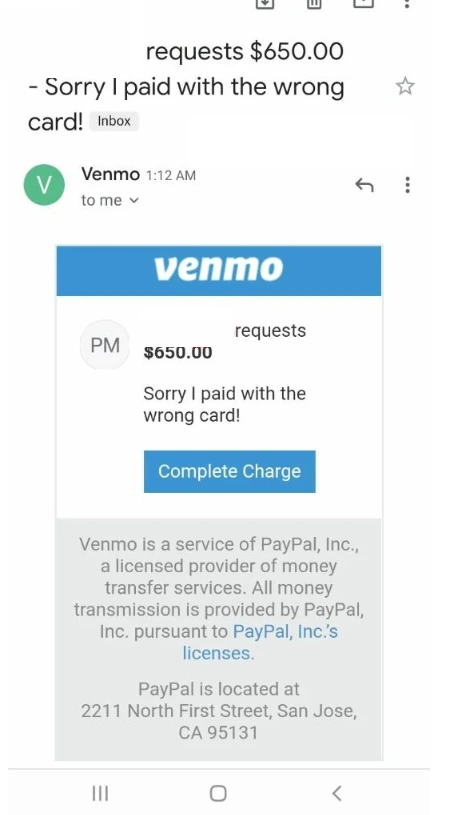

Venmo refund scams

Refund scams are quite common on Venmo. In this scenario, scammers initiate a payment to a Venmo user but quickly reach out to the user and claim that the payment was sent by mistake. They then request a refund, often catching the unsuspecting victim off-guard.

However, it’s important to note that these scammers initially make the payment using either a stolen credit card or a temporary bank account. When the account owner realizes this and disputes the charge, Venmo invalidates the original transaction, leaving the victim at a loss.

Here’s how this scam might look like:

Venmo payment scams

Another type of scam you should be cautious about is ‘payment scams.’ These scams usually occur when a user sells a product or service to someone they don’t know well. The buyer sends money through Venmo to complete the transaction,appearing legitimate.

Unfortunately, these payments turn out to be fraudulent as they are associated with hacked accounts or temporary bank accounts. Once the scam is discovered, Venmo will reverse the initial transaction, resulting in the seller losing both the money and the item they sold.

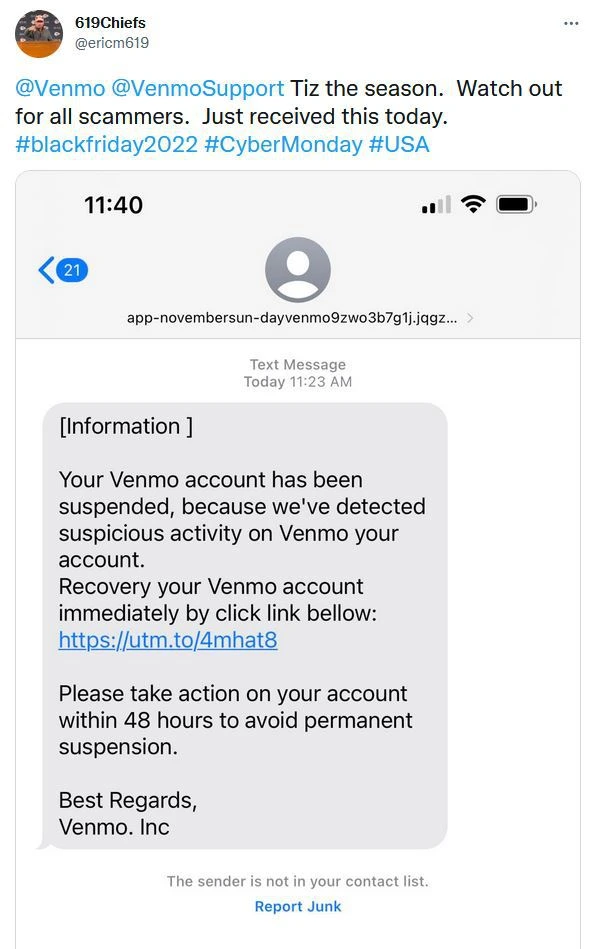

Venmo phishing scams

There are more deceptive forms of Venmo scams known as phishing and smishing scams that specifically target unsuspecting users. In these cases, scammers pretend to be customer service representatives from Venmo via email (phishing) or text message (smishing).

These messages often create a false sense of urgency by claiming that the user’s account is at risk or that immediate action is required for a transaction. The scammer then prompts the user to click on a link, which redirects them to a Venmo login page (which is not actually connected to the company). By providing their login credentials on this fraudulent page, the scammer gains access to the user’s Venmo account and can easily drain the funds of any connected accounts and cards.

Below is an example of a Venmo phishing email:

Venmo call scams

Another deceptive tactic employed by fraudsters are Venmo scam calls. In this scenario, the scammer calls the victim and pretends to be a customer service agent. During these calls, they may falsely assert suspicious activity on your account or claim there’s an issue with a specific transaction.

Using well-documented manipulation techniques, these scammers

convince the unsuspecting user to share sensitive information like the password or PIN. Armed with this information, they can access the Venmo account and deplete it completely.

Keep in mind that Venmo will never call you directly to verify your account information. If someone claiming to be from Venmo calls you, it’s always best to end the call and reach out to Venmo’s official customer service through their website or app.

Fake prize scams on Venmo

In these scenarios, scammers tempt users with the promise of winning a big prize or bonus. The scam usually starts with a message, either on social media or as a message through the Venmo platform, informing the user that they have won a prize.

However, in order to claim the prize, they are asked to provide personal information or make a payment. Unfortunately, once the user complies, the scammer disappears with their details or money, and the victim realizes that there was never a real prize.

It is important for users to exercise caution when encountering offers of free money or prizes, especially if they are asked for sensitive information or upfront payments. Always take time to verify the legitimacy of any offers, especially when they sound too good to be true, before releasing your personal information.

How to avoid Venmo scams

At this point, you might be wondering — how to avoid falling victim to Venmo scams? To safeguard yourself against the myriad scams used through Venmo, we recommend the following precautions:

- Stick to Familiar Contacts. Limit your Venmo transactions to individuals you personally know and trust. Avoid engaging in financial dealings with strangers via Venmo, as this greatly increases the risk of encountering fraudulent activities.

- Keep Sensitive Information Private. Never disclose your Venmo login credentials, PIN or any personal details. Remember that genuine Venmo representatives will never request such information from you. If you receive any requests asking for such data, it’s likely a scam.

- Verify Transactions Carefully. Always double check the transaction details before hitting the ‘send’ button. Once a transaction is completed on Venmo, it cannot be reversed.

- Activate Security Features. Utilize all available security features provided by Venmo, such as PIN codes and fingerprint recognition. Ensure that your app is regularly updated to benefit from the latest security enhancements.

- Be Wary of Unrealistic Offers. Exercise caution when faced with offers that seem too good to be true—they almost always are! Approach unexpected financial windfalls, prizes or giveaways with skepticism.

- Monitor Account Activity. Regularly review your Venmo account activity to promptly identify any unusual or suspicious transactions. If anything appears out of the ordinary, report it immediately to Venmo’s support team.

How to report a scam on Venmo

If you suspect that you’ve been targeted by a scam on Venmo, it is crucial to report it promptly. Here’s how you can do that:

- Contact Venmo Support. Your first step should be reaching out directly to Venmo’s customer support. You can easily get in touch with them via the Venmo Help Center.

- Report Suspicious Emails or Texts. If you receive any suspicious emails or text messages claiming to be from Venmo, immediately forward them to [email protected].

- Contact Law Enforcement. If you have lost money due to a scam or if your account has been compromised, consider reporting the incident to your local law enforcement agency as well.=

- Report to FTC. Additionally, you can report the scam to the Federal Trade Commission using their complaint assistant tool.

Remember, the more information you can provide, the better. This will not only help in the investigation but also in preventing such scams in the future. So stay vigilant and always exercise caution while using Venmo or any other digital payment platform.

FAQs

Can hackers get into your Venmo?

Yes, it is possible for hackers to gain access to your Venmo account. This usually occurs when users fall victim to phishing scams or unknowingly share sensitive information like passwords or PINs.

Will Venmo refund money if scammed?

While Venmo does offer refund options through its Purchase Protection Program, these options generally apply only to transactions involving business accounts or personal accounts that meet specific criteria. Therefore, if you have transferred money to an unknown individual or become a victim of a scam on Venmo, it is unlikely that you will receive a refund.

How does Venmo protect users?

Venmo implements various security measures to protect its users. These measures include encrypting personal and financial information, sending alerts for any suspicious activity on your account and offering additional security features like PIN codes and fingerprint recognition. Additionally, Venmo provides the option for users to remotely sign out from all devices in case of device loss or theft.