There’s no denying that credit cards have become an integral part of our day-to-day lives. We depend on them to make our day-to-day transactions as fast and convenient as possible. Unfortunately, this also means that credit cards are a very attractive target for cybercriminals. Storing credit card information responsibly is no longer optional, but rather, downright necessary.

In this guide, we’ll show you exactly how to do just that, providing insights on how to take better care of your sensitive credit card information.

Let’s jump right in!

Why learn how to store credit card information safely?

Is securing your credit card information really that big of a deal? You may think we’re exaggerating, especially if you’ve never experienced these types of problems that befall those who treat this topic too lightly.

Of course, you don’t have to take our word for it — consider a 2023 study conducted by Security.org (a popular digital security research and review website). According to their data and analysis, about 65% of credit card holders in the US have fallen victim to credit card fraud at least once. That translates to around 151 million Americans, proving how widespread this threat has become and why people should start taking it seriously.

It is also worth noting that the financial setback caused by credit card scams can be quite significant. According to the same report, total fraudulent charges due to credit card details leaked by cybercriminals from 2021 to 2023 have reached a staggering $12 billion. What’s even crazier is that figure is likely to soar even higher in the coming years.

These statistics highlight that learning to store credit card information safely has become a necessity, something that no one can afford to take lightly. This guide comes in here; implementing the strategies outlined below’ll drastically reduce your chances of falling victim to credit card fraud.

Is it safe to use credit card online?

Now you might be wondering — if credit card scams are so widespread, is it ever safe to use your credit card to pay for something over the Internet? Is it something that you should avoid altogether? Well, not quite; it’s still reasonably safe to use your credit cards online as long as you take the necessary precautions.

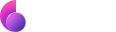

For starters, you should make sure that you only spend money with websites that have the padlock symbol and “https” in the URL. This indicates that any information you send to that website is encrypted and much harder for hackers to intercept.

Amazon is a great example of a website that leverages this security feature.

In addition, you will want to avoid sending any sensitive information over public Wi-Fi networks. These unsecured networks are often littered with vulnerabilities that hackers can exploit to steal sensitive information. A good rule of thumb is to only use your credit card information over a network connection that you own, keep it protected with a safe password, and, in every way possible, have full control over it.

How to protect your credit card from hackers?

Having established the significance of keeping your credit card information secure, let’s go over the steps you can follow to accomplish this goal.

This list includes some of the best practices that you should keep in mind:

- Monitoring your credit card accounts regularly and enable mobile alert notifications. Internet banking has made it easier-than-ever to monitor transactions in real time and spot any suspicious activity.

- Quickly report any unusual transactions you find. The sooner your bank knows about it, the faster it can establish a hold on the account and minimize any damage.

- Enable two-factor authentication and mobile notifications for all credit card transactions. That way, even if a hacker does get a hold of your credit card number and CVV code, none of the fraudulent transactions will go through without a confirmation code (usually a code sent via SMS message or email).

Keep in mind that the best overall defense against credit card fraud (or any type of scam, for that matter) is to stay vigilant. Make good use of any and all security features available to you and report anything that seems unusual. After all, when your finances are on the line, it’s always better to be safe than sorry.

How to avoid credit card fraud?

Of course, hackers are not the only thing you should look out for when securing your credit card information. In fact, many cases of credit card fraud are due to simple carelessness on the part of the cardholder.

For example, some people keep notes about their credit card details inside their wallet (often right next to the credit card itself). If that wallet gets lost or stolen, then it will be too easy for anyone to run fraudulent charges on that card.

So how can you protect yourself against credit card fraud?

If you want to keep yourself safe from credit card fraud, then you must start storing that information more responsibly. A big part of that is becoming more proactive and anticipating threats regardless of probability.

We recommend the following:

- Commit your credit card information to memory, instead of noting it down on paper or digitally.

- Don’t disclose your PIN or CVV information to anyone. This information is solely for the cardholder.

- Be cautious when using your credit card in ATM machines, gas stations, and self-checkout counters. Cybercriminals can tamper with these facilities to steal credit card information.

- Check your credit report regularly. Be on the lookout for transactions that you don’t recognize or the creation of unauthorized accounts.

- Consider signing up for credit monitoring services like IdentityForce and ID Watchdog. These services can watch over your sensitive information (including your credit card) and notify you of any suspicious threats.

Above are just a few examples of things you can start doing right now to protect your credit card information. You have the power to keep it from falling into the wrong hands. By taking proactive measures and being mindful of potential threats, you dramatically reduce your risk of becoming a victim of credit card fraud.

How to send credit card information securely?

No doubt there will be times when you need to send your credit card details to a third party (such as when paying for a product or service online). In such cases, you can take certain steps towards making sure you send this information securely.

In this section, we’ll go over a few methods that will help you send credit card information safely over the Internet. These methods add another layer of protection that will make it as difficult as possible (if not altogether impossible) for hackers to get their hands on your credit card details.

How to safely send credit card details by email?

Mainstream email service providers like Yahoo and Gmail are not specifically designed to encrypt sensitive information. We recommend that you avoid sending credit card information via these email platforms.

Instead, you can opt for secure email services that offer end-to-end encryption. Only the intended recipient can access and read the email, making it much more difficult for hackers to intercept your information.

One good example of a secure email service is ProtonMail. It uses end-to-end encryption and also offers a self-destruct feature for emails, ensuring that your sensitive information stays safe even after it’s been read.

How to encrypt credit card information?

Of course, a far more common scenario for sharing credit card information is through a web browser, such as when making online purchases—a perfectly normal event, in this day and age. If we’re going to share this information online, how can we ensure that it’s encrypted and protected from hackers?

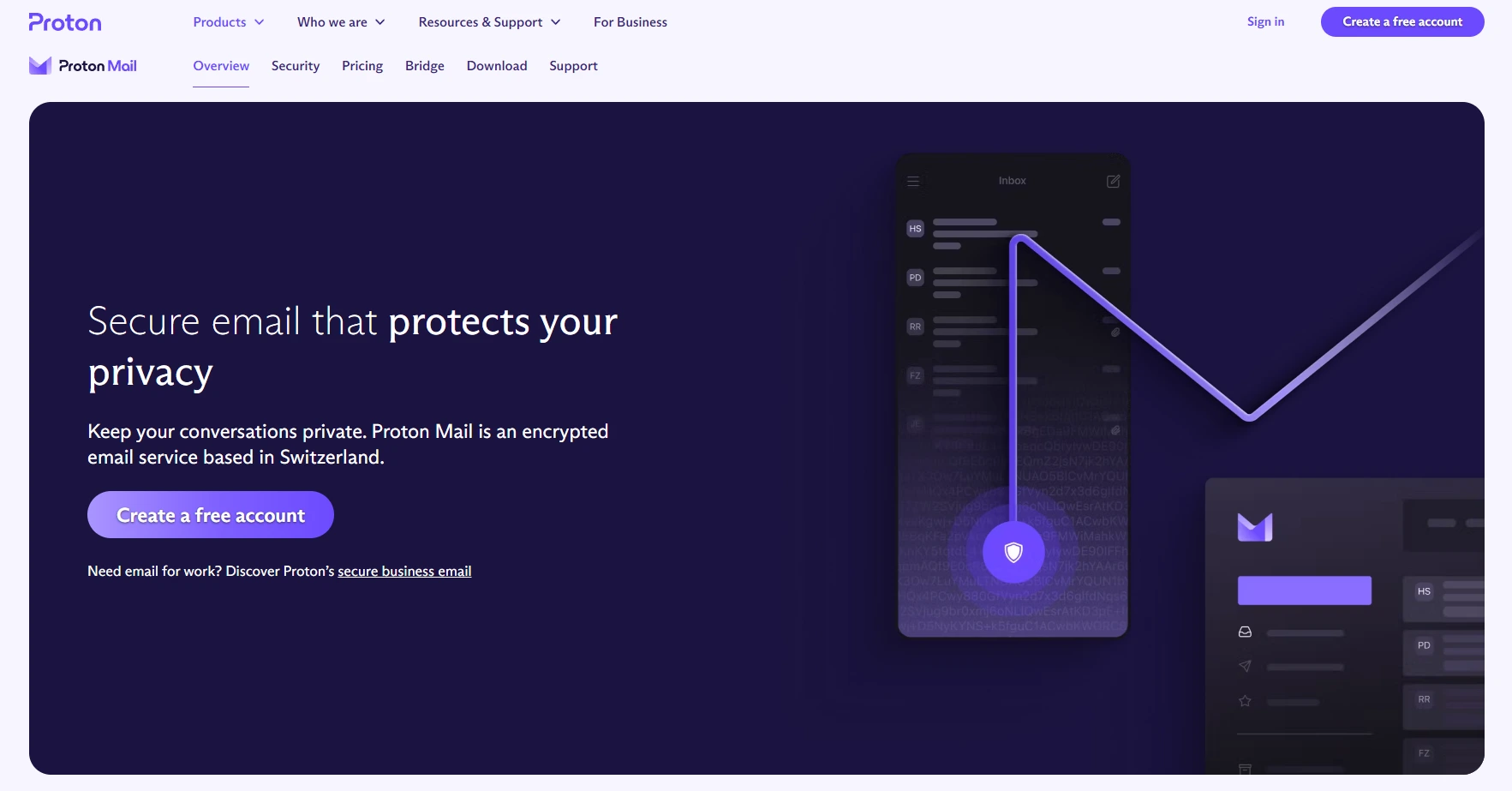

One effective solution is to use a premium VPN (Virtual Private Network) service when sharing sensitive information online. A VPN creates an encrypted tunnel between your device and the website you’re accessing, making it nearly impossible for hackers to intercept your data.

Think of it this way — without a VPN, your data is like an open book that anyone can read. But with a VPN, it’s like sending your data in a locked safe that only the intended recipient (in this case, the website you wish to transact with) can unlock.

The best part is that you can easily start doing all this today with ClearVPN — a fast, premium VPN service designed with security and simplicity in mind. All it takes is a few minutes to download, install, and run the ClearVPN app on your device. You can then enable the “Smart connection” feature and start enjoying secure, encrypted connections wherever you go online.

What’s more is that ClearVPN runs on most devices, including desktops, laptops, smartphones, and tablets. So, whatever device you use to make online transactions, you can rest easy knowing that your credit card information is encrypted.

FAQs

Is it safe to give your credit card number over the phone?

No, especially if it’s on an unsolicited call. If you must provide this information, we recommend hanging up, locating the verified number of the interested party, and initiating the call yourself. This ensures that you’re talking to a person who is actually associated with the organization before giving out information.

Which card details cannot be stored?

According to PCI DSS (Payment Card Industry Data Security Standard), certain cardholder information should not be stored under any circumstances. This includes any sensitive authentication data, such as full magnetic stripe data, PIN, and CVV codes.

Can someone use my credit card with just the number and CVV?

Yes, unfortunately, it is possible for someone to make unauthorized purchases with your credit card information. They would only need your credit card number and CVV, especially for online transactions.