In the digital age, we’re all too familiar with the pesky spam emails trying to steal our information. But have you ever heard of vishing? If you haven’t, it’s time to sit up and take notice. This form of scam is gaining popularity among cybercriminals due to its effectiveness.

According to a report by Truecaller (a caller ID and spam blocker app), more than 56.2 million Americans fell victim to phishing scams in 2023 alone. Totally $25.4 billion in losses with an average loss of $452 per victim. That’s a significant amount of money and all the more reason to be aware of vishing.

In this quick guide, we’ll explain what vishing is, how it works, and the steps you can take to protect yourself. So let’s jump right in!

What is a Vishing?

“Vishing” is a portmanteau, basically the combination of two terms — “voice” and “phishing.” It’s a type of fraud carried out over the phone via calls or voice message.

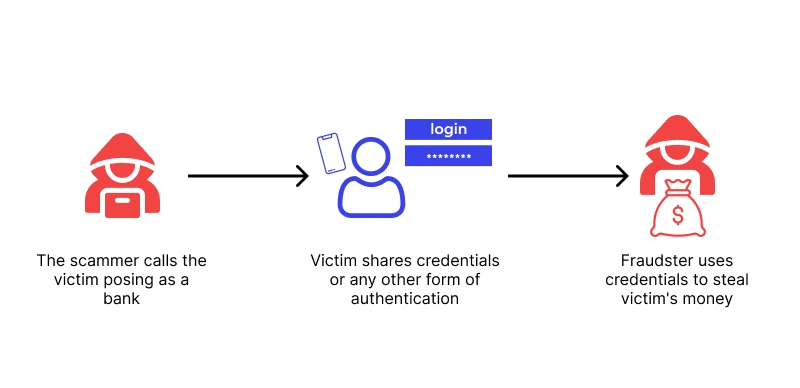

Perpetrators of vishing attacks (vishers) usually pretend to be a representative of a reputable organization or a bank. They then use that fake identity to trick their victims into revealing sensitive information such as social security numbers, credit card numbers, passwords, etc.

One thing that makes vishing scams dangerous is that it uses social engineering tactics to take advantage of their victim’s trust. If you’ve never heard about these scams before, then you’ll likely find that these calls seem very convincing and real.

How does Vishing work?

To understand how Vishing works, let’s take a look at its four major stages:

- Research: Like any other scam, vishers carry out extensive research on their targets before initiating their attack. This allows them to gather personal information and craft convincing messages tailored for that individual.

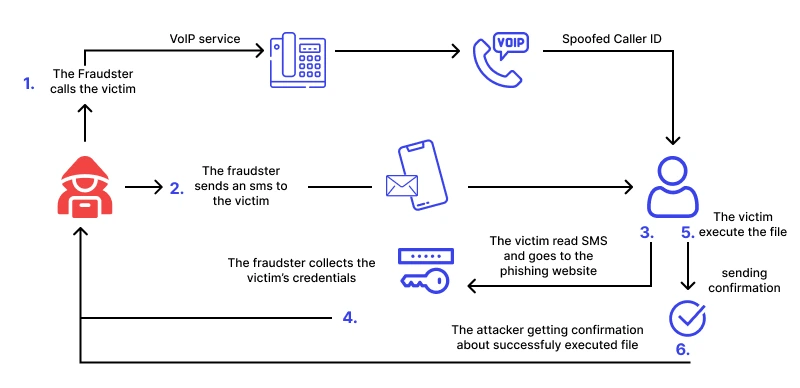

- Initiation: Vishers will typically initiate contact via automated or pre-recorded calls that sound like they are coming from a legitimate organization.

- Manipulation: Once the victim is hooked, vishers will use psychological tactics to pressure their targets into revealing sensitive information and taking certain actions such as transferring money.

- Theft: Finally, the scammers make off with the stolen personal data or monetary funds once they have what they need.

Among the most common vishing examples include callers pretending to be from the IRS or law enforcement who threaten victims with monetary fines for not paying taxes. Vishers can also pretend to be a bank representative asking you to verify information or else they’ll have to close or suspend your account (or something along these lines).

How to identify Vishing attacks?

Now that you have a good idea of what vishing is and how it works, this brings up a bigger question — how do you protect yourself from it? Well, you can start by learning how to identify a vishing attack as a first line of defense.

Vishing attacks can be extremely crafty, but there are telltale signs that give these scams away:

- Urgency in tone. Scammers often create a sense of panic to rush you into revealing your details without much thought.

- Asking for sensitive information like passwords, PINs, or credit card numbers. Remember, legitimate organizations will never ask for these details over the phone.

- Suspicious caller ID. While it’s possible to spoof legitimate numbers, many still use obviously fake ones.

If you spot any of the above signs, it’s best to hang up and call the company directly using a verified number. Don’t click any links sent via text message, as they may contain malicious content that’ll infect your device.

How to prevent Vishing?

Of course, it’s not enough to recognize phishing attacks and you’d want to look into preventing such attacks from happening in the first place. Preventing a vishing scam might seem daunting, but it’s certainly possible by taking a few proactive measures:

- Never share sensitive information over the phone: As a rule of thumb, never give out your personal details, especially financial information, over a phone call. If you have doubts about the caller’s identity, hang up and contact the company directly.

- Stay informed: Knowledge is power. The more you know about the latest vishing scams, the better equipped you’ll be to spot them. Regularly check reliable news sources for updates on common vishing techniques.

- Use caller ID: Most smartphones have a built-in caller ID feature. Take advantage of it to filter your contacts and only accept calls from numbers that you recognize.

- Notify the authorities: Vishing calls can go unpunished if left unreported. If you think you might have been the target of one, then report the incident to law enforcement agencies. You might just save someone from becoming the next victim.

Additional tips on how to avoid Vishing

Here are a few additional measures you can take that’ll drastically reduce your chances of becoming a target of vishing attacks:

- Always be suspicious of unsolicited communication: This is a good rule of thumb and one that will save you from just about any type of scam. No matter what the person on the other line is saying, hang up and verify the matter. Better safe than sorry.

- Sign up for the National Do Not Call Registry: This not only reduces the number of spam calls you’ll have to deal with, but it also makes it harder for vishers to target your contact information.

- Never stop learning about the latest scams: Cybercriminals are always looking for clever ways to defraud their victims.

Keep in mind that your best protection against vishing (or any other type of scam, for that matter) is knowledge and vigilance.

FAQs

Is phishing the same thing as vishing?

They are similar in that they are both scams designed to steal sensitive information from unwary victims. The only difference is the means of delivery. Phishing is carried out via email while vishing is executed over the phone.

How common are vishing attacks?

Cases of vishing have skyrocketed over the past few years, especially during the COVID-19 pandemic. According to a 2022 survey by Aura (a mobile security company), the average American receives 31 spam calls in a month. That’s a lot of potential vishing attempts!

What is the most common angle for a vishing attack?

Bank Impersonation scheme — the perpetrator of a vishing attack pretends to be a representative of a reputable bank and attempts to trick their victim in revealing sensitive information about their account.